Businesses Hit Firm With $45 Million Malpractice Suit

The New York Law Journal by Christine Simmons - April 23, 2012

Six business owners are suing Morrison Cohen and one of its partners for $45 million in damages, claiming in a malpractice suit that they overlooked critical language in a transaction. The plaintiffs suing Morrison Cohen and Brian Snarr, chair of the firm's compensation, benefits and employment department, are small to mid-sized business owners who sold shares of their businesses through employee stock ownership plan transactions, according to the lawsuit filed last week in Manhattan Supreme Court.

Read the complaint.

The plaintiffs sought to defer capital gains and capital gains taxes on the sales by reinvesting the proceeds in U.S. corporate bonds. The bonds were insured against default by certain financial guaranty insurers. Morrison Cohen represented and advised the plaintiffs during the transaction, the suit says.

Shortly before the closing of the transaction, the language in related documents was altered, creating a new default event tied to the ratings of the polices issued to insure the bonds, not simply the bonds themselves, according to the suit. The change in the documents "created a fundamental risk" in the reinvestment transaction that the plaintiffs didn't agree to and the law firm should not have allowed it to be inserted, the suit said.

David Rose, a partner at Pryor Cashman who represents the plaintiffs, declined to comment. Morrison Cohen managing partner David Scherl said his firm will not comment on pending litigation "other than to confirm that we will vigorously defend against the claims made."

CLICK HERE TO READ THE COMPLAINT

MLK said: "Injustice Anywhere is a Threat to Justice Everywhere"

End Corruption in the Courts!

Court employee, judge or citizen - Report Corruption in any Court Today !! As of June 15, 2016, we've received over 142,500 tips...KEEP THEM COMING !! Email: CorruptCourts@gmail.com

Most Read Stories

- Tembeckjian's Corrupt Judicial 'Ethics' Commission Out of Control

- As NY Judges' Pay Fiasco Grows, Judicial 'Ethics' Chief Enjoys Public-Paid Perks

- New York Judges Disgraced Again

- Wall Street Journal: When our Trusted Officials Lie

- Massive Attorney Conflict in Madoff Scam

- FBI Probes Threats on Federal Witnesses in New York Ethics Scandal

- Federal Judge: "But you destroyed the faith of the people in their government."

- Attorney Gives New Meaning to Oral Argument

- Wannabe Judge Attorney Writes About Ethical Dilemmas SHE Failed to Report

- 3 Judges Covered Crony's 9/11 Donation Fraud

- Former NY State Chief Court Clerk Sues Judges in Federal Court

- Concealing the Truth at the Attorney Ethics Committee

- NY Ethics Scandal Tied to International Espionage Scheme

- Westchester Surrogate's Court's Dastardly Deeds

Saturday, April 21, 2012

Subscribe to:

Post Comments (Atom)

Blog Archive

-

▼

2012

(320)

-

▼

April

(91)

- Attorney-Prosecutor Plays Sex-Abuse Politics

- Attorney-Prosecutors Playing Politics, Public Not ...

- Judge Says Sentence Appears 'Vindictive'

- Federal Judge Has Never Seen Such a 'Botched Situa...

- Manhattan DA Vance Examining Top Legal Wrongdoing

- The 'Secret' American Laws You Have to Pay to See

- States with the Most Lax Anti-Corruption Laws

- Former NYS Lawyer Sentenced for Making Racist Calls

- A Legal Perspective: 'You Have to be Kidding'

- Meaningless Judicial Meetings Planned

- Citing Judge's 'Disdain' for Defendant, Panel Corr...

- Lawyer Pleads Guilty to Fraud After Targeting FBI ...

- State Appeals Court Judge Arrested on DUI Charges

- Attorney's Flagrant Disregard for Clients Gets Rep...

- Battle Over Accurate Court Docs Continues

- Judge Corrects "judge's" Student Loan Decision

- Disbarred NY Lawyer Faces NJ Charges of Forging Cl...

- Attorney Arrested for Recording Cops in Public Rec...

- Walmart Scandal Points to U.S. Corruption Hypocrisy

- First Ever Bid to a Remove Alaska Judge

- Judge Will Not Reinstate Suspended Sheriff

- Big Corp's Issues With Corrupt Judges....Outside U.S.

- Corrupt Minority Holds Honorable Legal Ethics Hostage

- Lawyer's 'Outrageous' Conduct Leads to $10,000 San...

- 4 Top Appellate Division Justices to Meet in Secret

- Law Firm Hit With $45 Million Malpractice Suit

- Law School Did Not Mislead Students, Judge Finds

- Bank Fraud Attorney Gets Law License Yanked

- Former Law Student Indicted For Break-In

- Lawyer Among Three Mortgage Loan Officers Who Plea...

- Email-Hacking Attorney Barred From Using Computer ...

- Court Cuts Homeowner's Debt, Says Bank's Lawyers A...

- The Scam of Immunity Grows

- Man Offers Judge $100,000.00 to Sway Grand Jury Mu...

- Judge Wannabe Arrested for Records Tampering, Nast...

- Judge Finds District Attorney's Interview Tactics ...

- Family Court Secrecy Continues as Lawyers Circle

- ‘Best’ Attorneys Money Can Buy

- Retaliation and Civil Rights Violations Are Alive ...

- New Twist in Ambulance-Chasing: Lawyers Clog Court...

- Special Prosecutor Possible in Judicial Misconduct...

- Lawyer Convicted For Phony Docs

- Police Investigate Reported Hostage at Law Office

- Why Are Federal Courts Silent on Law Enforcement T...

- New York Judge Fines Himself

- Chief Judge Finally Addresses Foreclosure Fiasco

- Perfect Example of NY's Corrupt Court System's Cri...

- Editorial Asks, "Is This Judge a 'Criminal Justice...

- Judge Arrested for Taking Pics of Man at Urinal

- Judge Arrested for Shoving Deputy

- Federal Court Rules Workers Have No 1st Amendment ...

- Judges Press Claim for Retroactive Pay Based on 20...

- Lippman Indicted in Alleged Bank and Election Frauds

- New York: The Retaliation Capital of the World - '...

- Former Top Prosecutor Disbarred for 'Defiled Publi...

- Judge Reprimanded For Ordering Release of His Son

- Judge's Failure to Exclude Juror Who Knew Witnesse...

- Judge Fines Attorney $500 For Premeditated, Blatan...

- Federal Court Holds New York State 'Responsible Fo...

- New Foreclosure Rules Conveniently Ignore Attorney...

- 'Hero Judge of the Day' Sanctions Prosecutor for M...

- Silent On Big Corruption, Newspaper Realizes 'Corr...

- Bring the Justices Back to Earth With Term Limits

- Background on Quitting Judge: Insight Into a Dysfu...

- Though a Career Insider, Judge Poised to Make His ...

- Judge Abruptly Quits, Walks Off Bench at Lunchtime

- Lawyers or Grave Robbers? - Make Inheritance Law W...

- Court Commissioner Admonished for Belittling Famil...

- Governor Misses Opportunity To Address Judicial Et...

- Ineffective Assistance of Counsel Leaves High Cour...

- Lawyer Involved in Mortgage Fraud Among 8 Disbarre...

- Judge Karen Peters to Lead Third Department Appell...

- Nursing Home Lawyer-Owner is Convicted of $33 Mill...

- Attorney Imprisoned for Insider Trading Is Disbarred

- Attorney Pleads Guilty to Running Immigration Mill

- Federal Judge Slashes Fees in 'Production Mill' De...

- Ethical Bank Attorneys Still Missing In Action - W...

- Corrupt Court System Adopts Laughable Hiring Rules

- Federal Judge Allows Pro Se Suit Over Government H...

- Suffolk Lawyer Is Accused of Mortgage Fraud

- Corrupt Ethics Committee Issues Report on Selectiv...

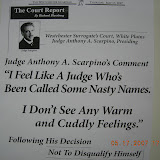

- Corrupt Judge Anthony Scarpino Signs-Off on Astor ...

- Federal Judge Shines Light On Buying Influence

- Panel Cites Town Justice for Out-of-Court Conversa...

- Court Rejects Bid to Halt Pay Increases for Judges

- Justice is a Bigger Gamble Than a Lottery

- Feds Expanding Probes in Foreclosure Frauds

- Federal Prosecutor Says 'The Fix Was In' in Judici...

- Judicial Bribery Scandal Back in the News

- The U.S. Supreme Court Defines Itself

- N.J. Constitution Allows Changes to Judges' Benefits

-

▼

April

(91)

See Video of Senator John L. Sampson's 1st Hearing on Court 'Ethics' Corruption

The first hearing, held in Albany on June 8, 2009 hearing is on two videos:

Video of 1st Hearing on Court 'Ethics' Corruption

The June 8, 2009 hearing is on two videos:

7 comments:

Cat fight and a lot of legal fees. In the end, the non-lawyer will lose everything.

This is just another scam by a bunch of greedy lawyers. Big money will be paid out by the insurance companies. Everyone loses except the lawyers, including the insurance companies. That's the rule.

Did you think your lawyer works for you? Did you trust your lawyer? Do you think the lawyer suing the other lawyers is any different? Wanna buy a bridge with guaranteed toll revenue?

Dont you just love it when low life scum attorneys fight! It kind of gives you some faith in the corrupt system!

It is all part of their scam. Like a skit. All planned in advance. No fiduciary.

Attorneys policing themselves borders on a monopoly. I sued Morrison Cohen and getting ready for a jury trial, my attorney forgot to put in the rebuttal to their expert.To get to trial, you must have a rebuttal to the opposing expert witness.But since they wear the same uniform, after three years of fact finding and depositions, Stephen J. Bury Esq. deliberately threw my case.

Judge Ling Cohan ruled, indicating that both my wife and I signed a note.. there was no loan signed by my wife. Ling-Cohan indicates, that a certain break in affected my inventory and I was unable to fulfill my orders. In the same ruling, my sales and profit margin went up. Based on tax returns. You can't make this stuff up, the sales are black and white, on an appeal Judge Louis Gonzalez basically mirrored Judge Ling Cohan but both judges indicate that my attorney did not put in my expert witness which is the appropriate standard of care required under the circumstances. Here are two judges indicating that the case is fixed. Morrison Cohen has a tendency to misrepresent and steal their clients money. Based on Federal Judge Jerome Fellers signed order, they were supposed to pay $360,000.00 in taxes from an I.O.L.A account. Cuomo is involved with the firm, knows about the complaint as State attorney and as Governor, he's involved with the firm and so is former Mayor Michael Bloomberg. Three signed letters to Bloomberg, several phone conversations with Andy...crickets all you hear is crickets.

Senator Kristin Gillibrand, multiple phone conversations, additional information...nothing. Peter King, One Police Plaza, Ray Kelly, Eric Dixon Esq. was asked to stand down. Anthony Bianchi Esq., John Macron Esq., I could name another 100 attorneys. Bottom line, the Federal Judge awarded their fees, they could have appealed. The firm took money in Federal Court without a signed order or fee application. They took third party money. And everyone wondering about Al Sharpton's way of doing business. Morrison Cohen,Bloomberg, Governor Coumo has broken more laws than Al Sharpton.

That's based on FOX, I wrote to Fox, to Roger Ailes in fact.I hope to hear from him. Usually Fox reaches out to Al Sharpton for a comment but he never responds. Maybe Roger Ailes can reach out to Bloomberg and Cuomo. Don't be surprised if they don't return Fox's call. No comment, pleading the fifth, usually means you're dirty and guilty. All they had to do is show me where my wife's signature was on the loan.

To put Bloomberg and Cuomo in the same category as Sharpton, to pillage my two corporations and steal tax money. That's what Fox keeps reporting about Sharpton. I have the US Trustee Linda Riffkin and a signed Federal order.

Please see my Google review of Morrison Cohen and Jeffrey P. Englander Super Lawyer.

Post a Comment